European PS market set to rise for second straight month

In Europe, the PS market is set to witness another round of increases for March after prices rebounded from their four-year low in early February. Players’ firmer expectations are mostly based on tight supplies across the region as well as strong upstream costs.

Firm expectations for March boost pre-buying activity

February PS business was mostly wrapped up last week with increases of around €20-40/ton over January. Sellers enjoyed buoyant demand towards their February cargoes amid widespread expectations that the firmer trend might gain speed in March.

Meanwhile, some players reported that firmer talks for March boosted pre-buying activities in the region as buyers were eager to secure some extra volumes before prices increase further in the upcoming month.

A distributor of a West European producer said, “We have recently concluded a few more February PS deals with increases of €30-40/ton. We are feeling free from any sales pressure as our PS allocations are limited and the outlook remains firm for March.”

Tightness keeps market firm

Distributors of different European PS producers reported that overall regional supplies remained low and they were not able to satisfy all customers’ needs for February.

Buyers also confirmed this situation as they had to seek material from different supply sources to maintain their operations.

A disposable kitchenware manufacturer in Belgium noted, “We settled our February PS contracts with hikes of €20-30/ton. It was difficult to secure all our needs this time due to most suppliers’ low stocks, which might give an upper hand to them in seeking a new round of increases for March.”

Styrene stands as the other supportive factor

According to data from ChemOrbis Price Wizard, the weekly average of spot styrene prices on CIF NWE basis has been chasing a stable to firmer trend for around six weeks, standing at its highest levels since early November.

Strong naphtha prices and crude oil futures have been contributing to the slightly firming trend in the spot styrene market while players believe that spot prices might receive extra support from the upcoming turnarounds at some regional crackers.

The uptrend in the spot styrene market is expected to pave the way for a higher monomer outcome for March, with players mostly talking about possible increases of €40-50/ton.

February styrene contracts were fully settled at €995/ton, up by €20/ton from January, meanwhile.

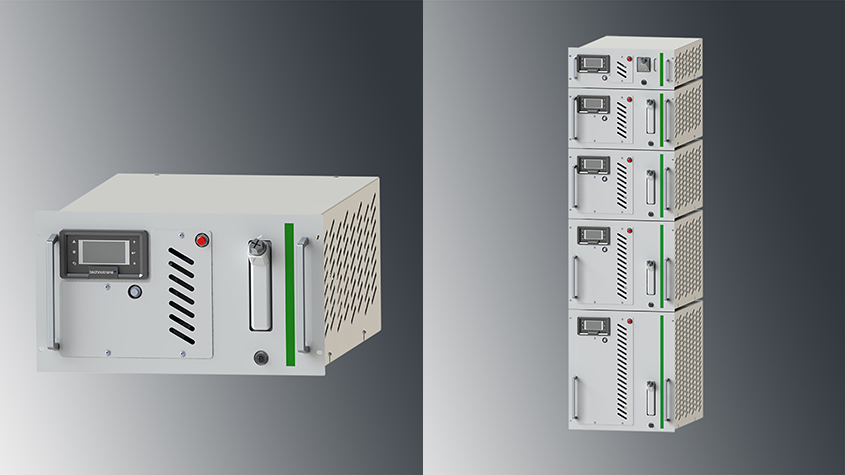

Teknor Apex Announces NEW Monprene® TPEs

Teknor Apex Announces NEW Monprene® TPEs with 60% Post-Consumer Recycled Content, Reducing…